The life of a whistle-blower isn’t easy, especially when nobody takes you seriously. That’s what Richard Bowen endured.

The Dallas-based senior vice president for Citigroup became one of America’s first whistle-blowers on the mortgage crisis. Yet, he says, nobody cared.

He battled not only the forces of his mega-corporation but also the federal government, which he says pretended to investigate his allegations but actually covered some of them up.

As readers of the Fort Worth Star-Telegram Dave Lieber Watchdog column first learned, in a public talk at the University of Texas at Dallas School of Management, where he’s a senior lecturer in accounting, Bowen revealed a new set of allegations. This time, his target wasn’t his former employer. It was the federal government, which he said did its best to protect top leaders of American finance.

Bowen lost his job as senior vice president and senior chief underwriter in Citigroup after he complained to top boss Robert E. Rubin about mortgages bought from other mortgage companies.

Bowen told Rubin, who had served as Treasury secretary under President Bill Clinton and has since retired as Citigroup’s chairman, that conditions were right for a big crash because those mortgages were not financially viable.

Bowen and his division supervised the purchases, but he says that even though his underwriters tried to deny purchases of large pools of mortgages from other companies, they were constantly overruled by higher-ups.

That story has been told before, most notably in a December 60 Minutes broadcast that profiled Bowen’s role as a whistle-blower.

But in February 2012, Bowen accused the U.S. Financial Crisis Inquiry Commission of forcing him to edit out his most important allegations before he went public. Watch his testimony here.

He says that his real testimony behind closed doors contains the meat of his allegations but that it remains locked away in the National Archives for five years.

– – – – – – – – – – – – – – – – – – – – – – – –

More Watchdog Nation News:

Watchdog Nation Partners with Mike Holmes

America meets Watchdog Nation/Listen to Fun Radio Interview

Watchdog Nation Debuts New e-Book and Multi-CD Audio Book

– – – – – – – – – – – – – – – – – – – – – – – –

And what was that meat? Citigroup not only was buying bulk mortgages that were defective but also knew they were harmful to its own investors.

If that sounds familiar, it’s because another division of Citigroup that Bowen did not supervise was in the spotlight in November when a federal judge rejected a $285 million settlement between Citigroup and the Securities and Exchange Commission.

The judge condemned the SEC’s practice, which is common in some federal and state agencies, of allowing a company to pay a fine without acknowledging wrongdoing.

The wording used is that a company neither admits nor denies its involvement in improper activities.

In that case, the SEC accused Citigroup of placing bad mortgages in a $1 billion fund it sold to investors so the fund would fail. The motivation, the SEC charged, was that Citigroup had bet against its customers and made money when the fund declined in value.

The mishandling of mortgages in Bowen’s division has never gone to court in either a civil or a criminal case, and he says that’s part of the problem. No one has been called to account for actions that helped lead to a financial meltdown from which the nation is still trying to recover.

Bowen’s infamous 2007 warning e-mail to Rubin was made public during the inquiry. In it, he warned Rubin and other top officials that most of the mortgages Citigroup bought as part of so-called mortgage pools were defective. He wrote that this happened because of “breakdowns of internal controls” and warned that the consequences would be “material financial losses.”

He calls his e-mail a “Hail Mary pass” that didn’t get caught.

Citigroup has said that after Bowen’s warning e-mail, “Citi took prompt action to address the issues.”

Bowen disputes that. “I sent e-mails. I gave weekly reports. I made presentations. I started yelling. Yet through 2006 and 2007, the volumes [of purchases] increased, and the rate of defective mortgages increased” in his division to as high as 80 percent.

Worse, he says, is that after he gave detailed testimony to the SEC, including what he says was proof that investors were misled, the SEC did not follow up with criminal or civil cases.

When the national financial commission began its investigation, Bowen was called as a witness and told to submit 30 pages of testimony, but “when they got it, it was as if the whole world changed.”

He was told to edit his testimony down by a third, to remove any references to the SEC and violations of the law, to delete “all names and specific incidents” and to not mention that he was removed from his job after the Rubin e-mail. He speculates that the Treasury Department was preparing to sell its Citigroup shares acquired in the bailout.

After Bowen concluded his testimony before the financial commission, Rubin testified, but the commission went easy on the Wall Street titan and never forced him to detail his reaction to Bowen’s warnings, according to Bowen.

Perhaps Bowen’s most serious charge is that the government never prosecuted Citigroup leaders who Bowen says falsely certified to the government that Citi’s financial status was more secure than it was.

In response, Citigroup provided me with a letter it originally sent to 60 Minutes. The company writes that “the issues raised by Mr. Bowen had no impact on the integrity or propriety of Citi’s financial statements or the accuracy of the certifications signed in connection with Citi’s year-end and quarterly public filings.”

Now, two years later, Bowen laments, “no major player has been held accountable.”

“I was accountable in my job, and it cost me,” he said. “There are no regrets. I did what I had to do.”

When he finished his lecture, he got a standing ovation. The U.S. economy remains in shambles. And Richard Bowen, who saw what others wouldn’t see and said what others wouldn’t say, teaches accounting and accountability in a college classroom.

What’s wrong with this picture?

Visit Watchdog Nation Headquarters![]()

Like Watchdog Nation on Facebook![]()

Watch Watchdog Nation on YouTube![]()

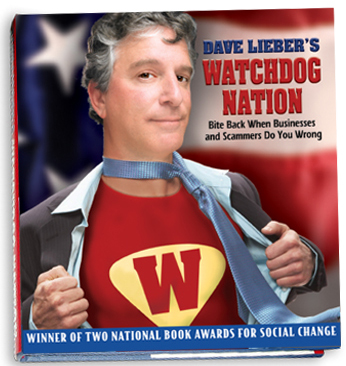

Are you tired of fighting the bank, the credit card company, the electric company and the phone company? They can be worse than scammers the way they treat customers. A popular book, Dave Lieber’s Watchdog Nation: Bite Back When Businesses and Scammers Do You Wrong, shows you how to fight back — and win! The book is available at WatchdogNation.com as a hardcover, CD audio book, e-book and hey, what else do you need? The author is The Watchdog columnist for the Fort Worth Star-Telegram. Visit our store. Now revised and expanded, the book won two national book awards for social change. Twitter @DaveLieber