Her father is 91 and still sharp, she says. He didn’t retire until a year ago. Then Nannette Samuelson and her brothers and sisters took control of his and their mother’s finances.

They didn’t like what they found.

An alarm salesman had pressured their dad, who lives in Fort Worth, Tx., into signing a contract he didn’t want. Hucksters seeking investors pursued him like prey. And then there was the credit card bill with 200 percent interest and an identity theft service he didn’t know he had bought.

Samuelson contacted me about the interest. She had recently studied interest rates in school and the 200 percent surprised her. After raising her children, she is earning a Master of Business Administration.

As more Americans take control of elderly parents’ finances, they are often surprised to learn how many face a barrage of unsavory financial opportunities and come-ons.

The alarm salesman showed up at her father’s door around dinnertime. He wouldn’t leave until the older man had signed a contract. As soon as he had, a team waiting outside installed the system.

The couple’s children later called the company to complain. It backed off and removed the alarm. “We got the money back, and now we have holes in the wall,” she says.

The ones who seek money for investments “call him up and hound him,” the daughter says. “And then a FedEx truck arrives at his house with forms. ‘Sign here and give us a check for this amount,’ and the FedEx guy takes it back.”

The couple’s children have tried to get some of the investments refunded. They hired a lawyer to write demand letters. Usually, there’s no response.

The daughter, embarrassed to reveal the actual amount, says more than $10,000 has been lost.

I was curious about the 200 percent interest rate on the year-old Shell gas credit card bill. The card is issued by Citi Cards, and a spokeswoman told me what happened. The bill had two monthly charges of $6.95 for the ID protection. Add to that a $2 monthly minimum finance charge. So the charge and the regular interest rate combined for 200 percent, the spokeswoman said.

As of July, credit card rules approved by the Federal Reserve require that bills show only the regular annual percentage rate, without added fees or charges. The bill must show additional fees in a separate box. Previously, the annual percentage rate included any additional fees.

The Federal Reserve made the change after asking consumers how to make credit card statements easier to understand. By separating fees from the listed interest rate — instead of combining them — Fed leaders hoped that the change would help.

But Samuelson says: “The change went the opposite way of being transparent. They’re not really charging you 15 percent interest if they charge you $2 on $13.90.”

She made sure her father’s monthly ID protection package was removed. She’s now on the lookout for the next trouble spot.

“In my MBA classes, they talk about ethical behavior and how to bring value to your customer,” she says, laughing. “And I come home and see these companies that prey on elderly people. It’s kind of the opposite of what I’m learning in the classes I’m taking.”

# # #

Read previous Watchdog Nation reports on senior scams:

Fighting financial exploitation of the elderly

Company that preyed on senior citizens forced to make restitution

An indictment for him, and a turning point for me

# # #

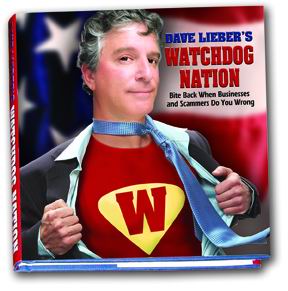

Dave Lieber, The Watchdog columnist for The Fort Worth Star-Telegram, is the founder of Watchdog Nation. The new 2010 edition of his book, Dave Lieber’s Watchdog Nation: Bite Back When Businesses and Scammers Do You Wrong, is out. Revised and expanded, the book won two national book awards in 2009 for social change. Twitter @DaveLieber