Imagine you get a $500 bill from a debt collector for an old cellphone that’s not yours.

You call the collection agency to dispute it, but an agent hangs up on you.

You contact AT&T, the company that hired the collection company, and they don’t know what happened.

So you contact Watchdog Nation.

That’s what Marijo Malesa of Fort Worth, Texas did after getting the runaround.

“I have always paid my bills on time,” the Crowley school district librarian told me. “I have excellent credit, so I was concerned when I received a notice from Palisades Collection, Llc., very official looking, that I had an outstanding debt.”

I looked up Palisades Collection on the Internet and learned that the New Jersey company collects outstanding debt from past-due cellphone bills for AT&T and Verizon, among others. Some consumers complained that they were charged with debts that weren’t theirs.

I called Palisades and spoke to Chris, a floor supervisor. He said he couldn’t talk due to privacy concerns. So I had Malesa send him a waiver letter. After she did, no one from the company would return my repeated calls for comment.

Quickly, though, I found several problems with the bill sent by Palisades. The name on the bill was not the name listed on Malesa’s old cellphone bills. The account number was incorrect. What’s more, Malesa had never lived at the address listed for the account.

Also, the bill was from six years ago. In many states, a person cannot sue for debt that old. [Check your state law here.]

One way to get a collection agency off your back is to sue. That’s what a Utah woman did in 2007. She sued Palisades Collection in federal court, saying that despite repeated explanations, Palisades kept harassing her for an AT&T wireless debt she didn’t owe.

The year before, Palisades had sued the woman for $1,800, but that complaint was dismissed. After the collection agency resumed sending collection letters, she sued.

Judson Pitts, her lawyer in Salt Lake City, told me this week that this is not uncommon. He found that after phone contracts are canceled, sometimes companies report ghost debt to credit bureaus. Collection agencies go after them.

“It depends on the company, and whether they do a good job on keeping track of their records,” he said.

Trying to explain the truth to collection agencies is difficult, he added. “Most companies won’t accept any information that consumers give them over the phone because they assume they’re making excuses or being dishonest.”

Pitts said he settled the case with Palisades out of court.

Last year, in a Pennsylvania bankruptcy case, Palisades was fined $11,000 in punitive damages for “arrogant defiance of federal bankruptcy law.”

According to Consumer Bankruptcy News, a consumer denied owing money for a Verizon wireless bill, but the company contacted the person every day for 24 days using an auto-dialer and a computer. A bankruptcy judge found that the company ignored pertinent information from the consumer.

This week, AT&T figured out what happened to the school librarian.

AT&T spokeswoman Meredith Adams explains: “In researching the issue, we learned that Palisades mistook Mrs. Malesa for another customer with a similar name who had an outstanding AT&T debt from several years ago.”

She added, “To resolve this issue for Mrs. Malesa, AT&T has taken back the debt, and she should no longer receive notices from Palisades Collection. Mrs. Malesa’s credit has not been affected by the agency’s notices of collection. On behalf of the collection agency, we apologize for any inconvenience this has caused her.”

If this happens to you, the first step is to read the Fair Debt Collection Practices Act. It spells out your rights in any debt-collection process.

If you are contacted by a debt collector with an inaccurate bill, send a dispute letter by certified mail with a return receipt. Under law, the collector is not allowed to contact you for 30 days.

Demand that the collector provide proof that you owe the debt. If collectors can’t, they aren’t supposed to call again.

In July, the Federal Trade Commission released a report on reforming debt-collection litigation. Two recommendations would affect a case such as Malesa’s.

The report says states should require collectors to include more data about the alleged debt in their legal complaints, and should work to make it less likely that collectors will sue for debt that’s expired because of a statute of limitations.

Fortunately, Malesa doesn’t have to sue.

She cheerfully told me, “My name is cleared, and no one will be bothering me anymore.”

# # #

Here’s an interesting anti-Palisades Collection website.

# # #

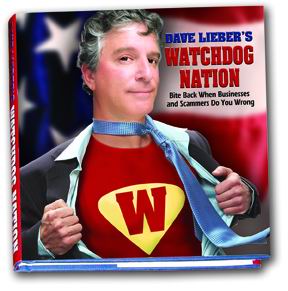

Dave Lieber, The Watchdog columnist for The Fort Worth Star-Telegram, is the founder of Watchdog Nation. The new 2010 edition of his book, Dave Lieber’s Watchdog Nation: Bite Back When Businesses and Scammers Do You Wrong, is out. Revised and expanded, the book won two national book awards in 2009 for social change. Twitter @DaveLieber